With the 2024 Presidential election just around the corner, many potential homebuyers and sellers wonder how this political event might influence the housing market. If you’re contemplating moving in real estate, it’s natural to question how such a significant event could affect your plans.

Understanding the Impact of Elections on Home Sales

Historically, the influence of Presidential elections on the housing market tends to be modest and often short-lived. One notable trend is that home sales usually experience a slight decline in November during election years. According to Ali Wolf, Chief Economist at Zonda, “In an election year, November sees a slowdown in home sales compared to non-election years.”

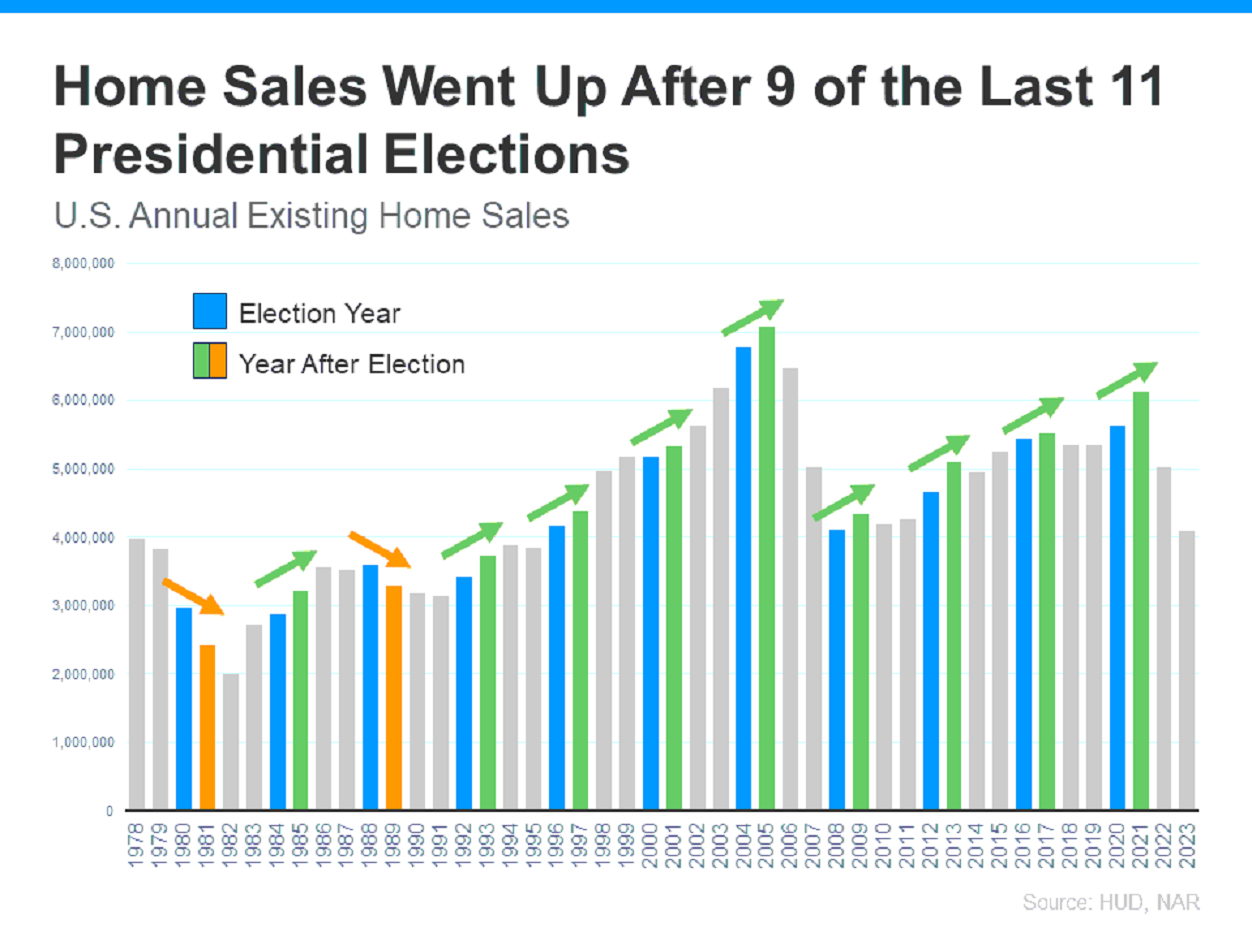

This hesitance often stems from uncertainty, leading many to postpone major financial decisions until after the election. However, it’s essential to recognize that this slowdown is typically temporary. Home sales generally rebound in December and continue to rise in the following year. Data from the Department of Housing and Urban Development (HUD) and the National Association of Realtors (NAR) supports this, revealing that after nine of the last eleven Presidential elections, home sales increased in the subsequent year.

Home Prices: Staying Resilient

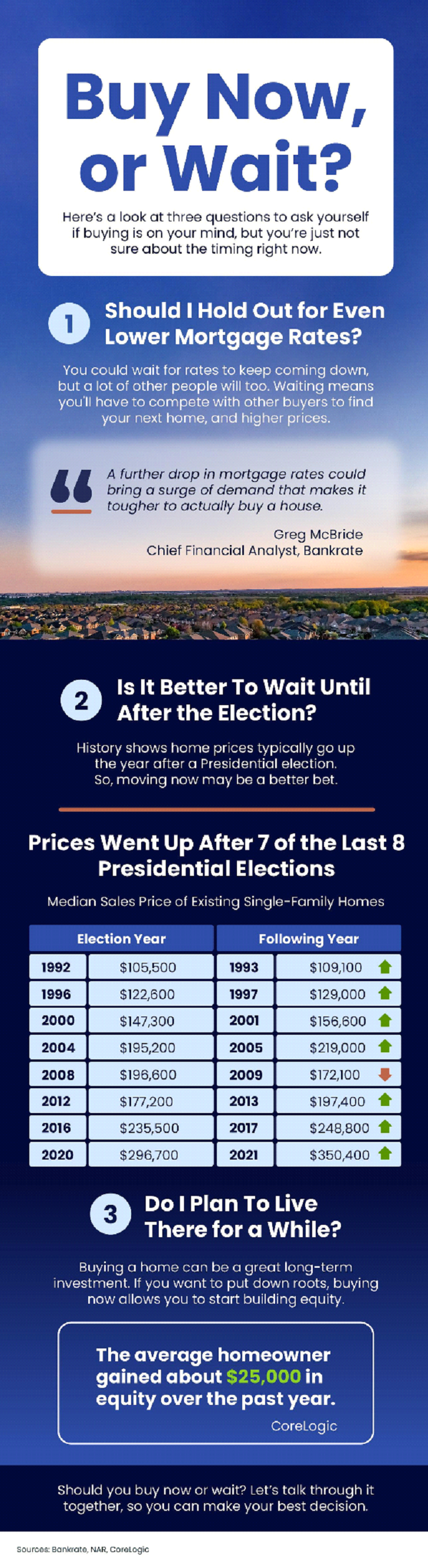

When it comes to home prices, the narrative is similarly reassuring. Many might wonder if prices drop during election years. In most cases, home prices have shown resilience, steadily increasing year-over-year, independent of election cycles. NAR data indicates that after seven of the last eight Presidential elections, home prices rose the following year, affirming that elections typically do not disrupt the upward trajectory of property values.

The Mortgage Rate Landscape

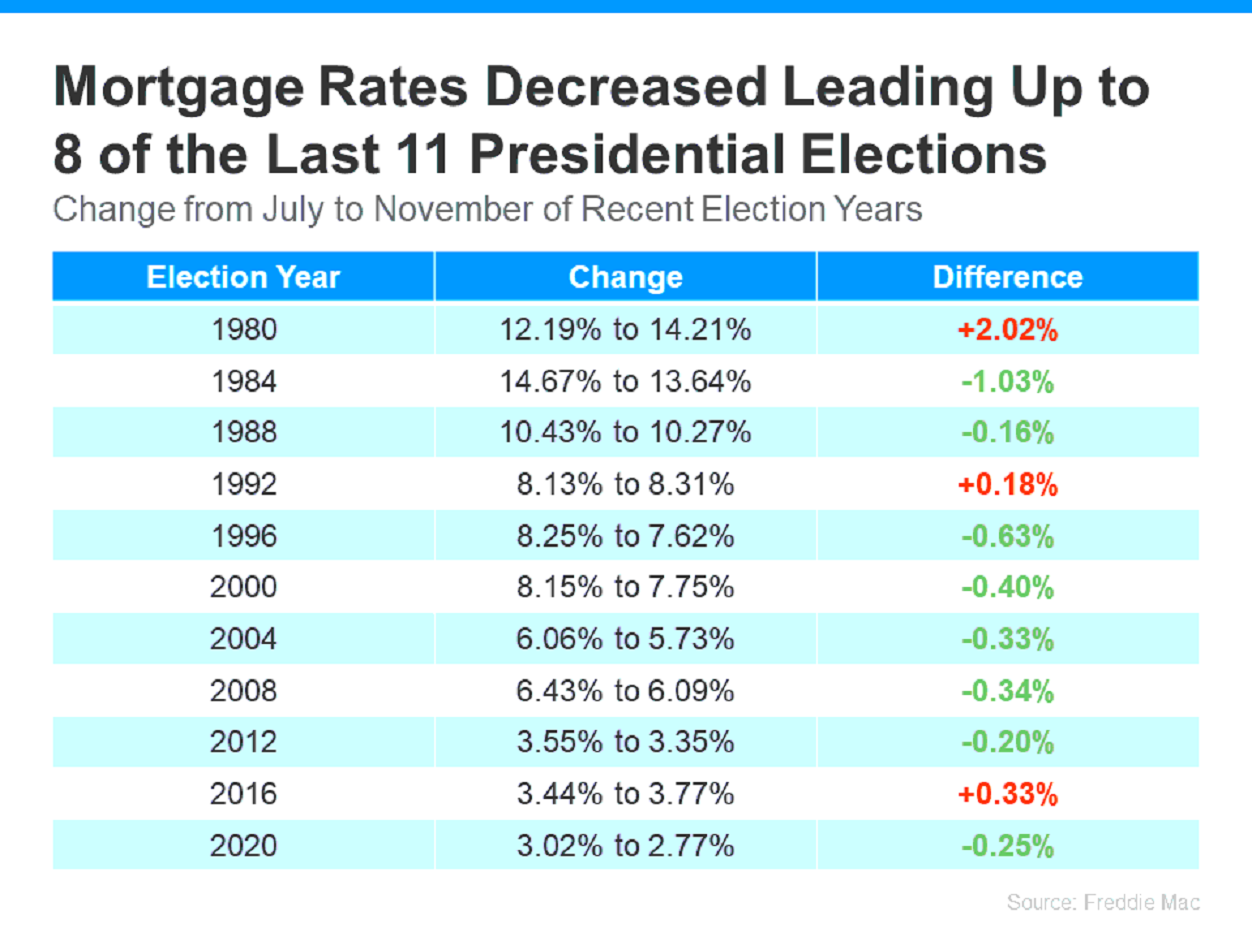

Mortgage rates play a crucial role in determining your monthly payment when buying a home. Historical data from Freddie Mac reveals a trend: in eight out of the last eleven Presidential election years, mortgage rates declined from July to November. Most forecasts suggest a slight easing of mortgage rates as we approach the end of the year, which would align with this historical pattern. For prospective homebuyers, lower rates translate into more affordable monthly payments.

Key Takeaways for Buyers and Sellers

What does this all mean for you as a potential buyer or seller? While elections can have some influence on the housing market, these effects are often minimal and transient. As Lisa Sturtevant, Chief Economist at Bright MLS, points out, “The housing market in presidential election years typically doesn’t look significantly different from other years.”

For the majority of buyers and sellers, the election cycle is unlikely to drastically impact their real estate decisions.

Conclusion

Feeling uneasy during an election year is understandable, but historical trends reveal that the housing market remains robust and resilient. If you have questions or concerns about navigating the real estate landscape during this time, don’t hesitate to contact your local real estate experts at Blue Marlin Real Estate. We’re here to guide you, regardless of the political climate.